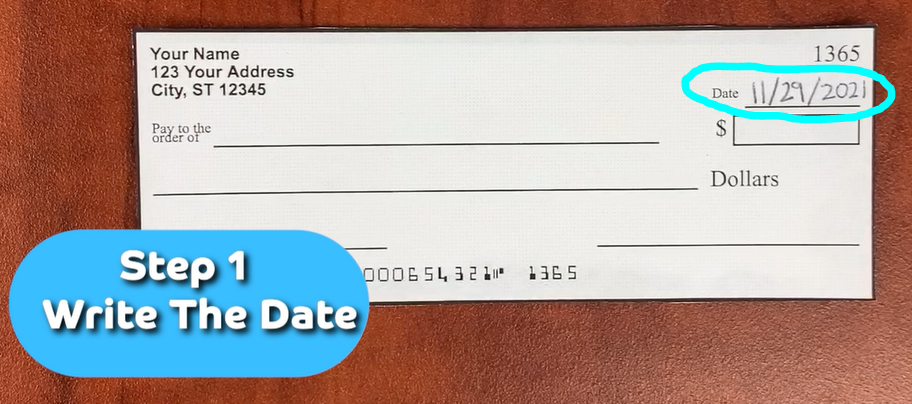

Step 1: Write The Date

In the top right hand corner of the check, write the date. You can write out the month completely or use numbers. Ex: Both November 29th, 2021 and 11/29/2021 are acceptable.

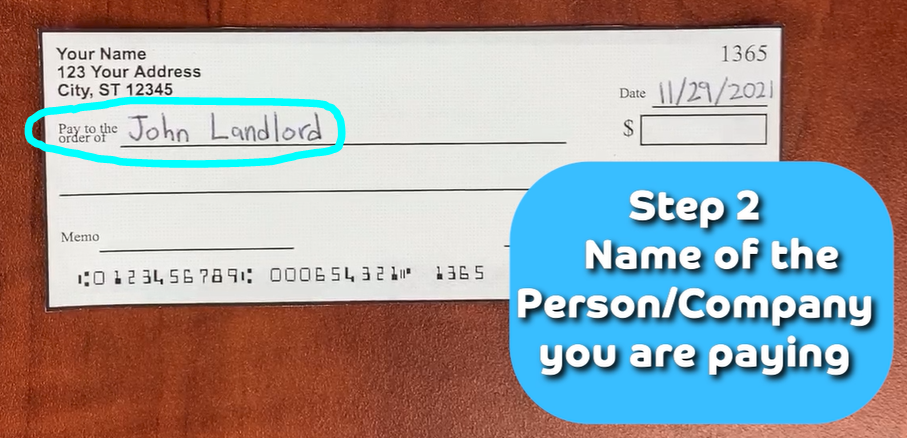

Step 2: Write the Payee

Payee is the recipient of the check. Write their name on the line “Pay to the order of.” This can be a person or organization name, but make sure not to use any nicknames.

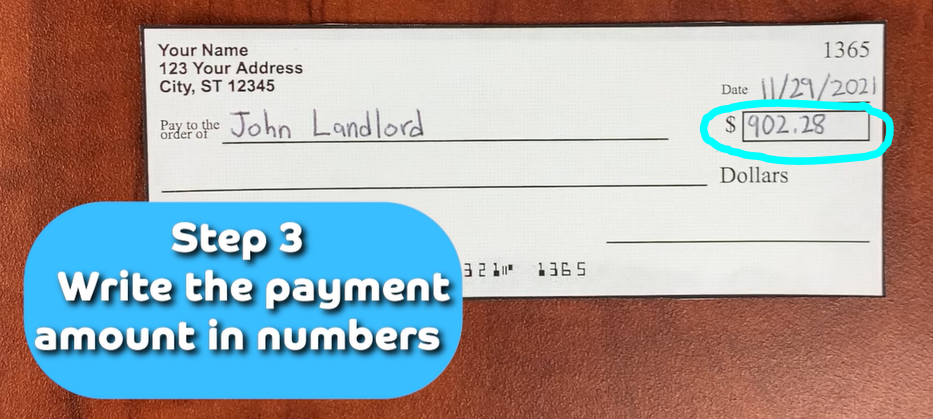

Step 3: Write Payment Amount in Numbers

Write out in numbers the amount of money you will be paying. To be safe, start to write all the way to the left of the box to ensure the number can’t be changed to another value.

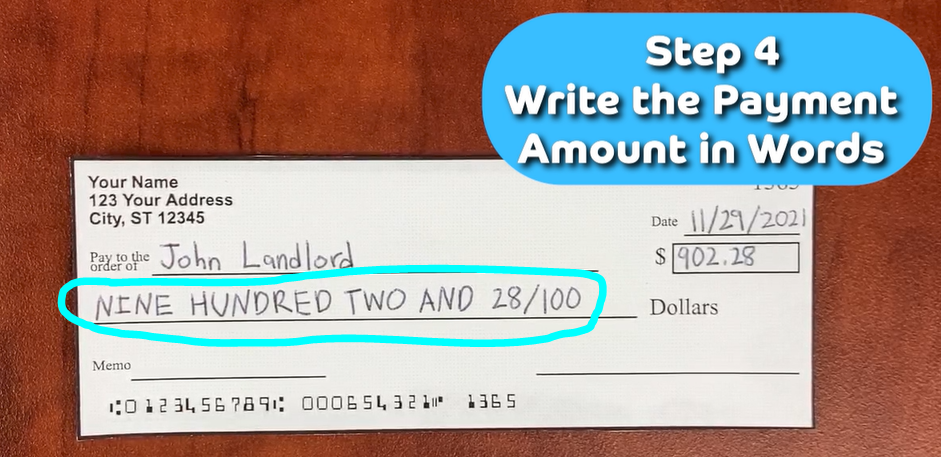

Step 4: Write Payment Amount in Words

Under the “Pay to the order of” line, write out the same amount you wrote in numbers, in words. Note if there are cents included, end the amount with the cents/100. Don’t know how to convert the number to words? Use this link to convert automatically convert your number value to words: https://hkcoding.com/en/checkconvert/.

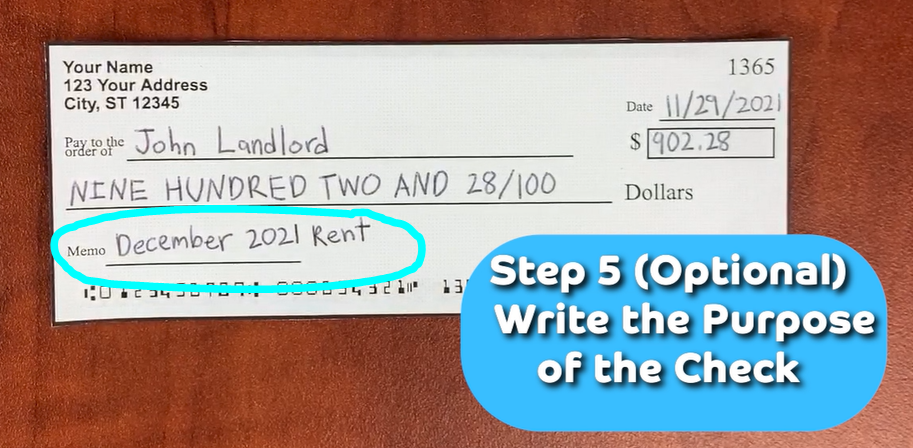

Step 5: Write the Memo (optional)

The memo describes what the check is for. This step is optional, but good to have so you and the recipient knows the purpose of the check.

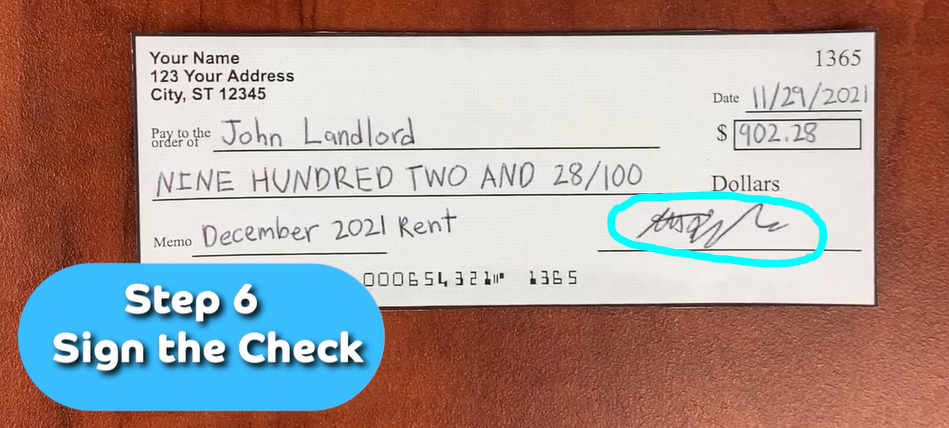

Step 6: Sign the Check

In the bottom right-hand corner, include your signature on the check. This is a very important step to ensure your check won’t be rejected.

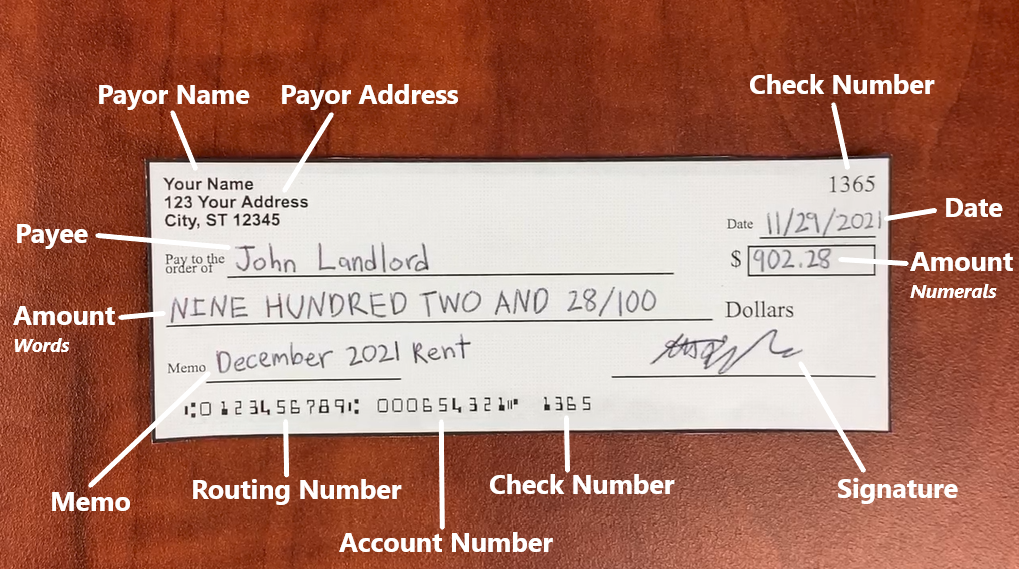

Anatomy of a Check

Definitions

- Payor Name: The person/entity who will be paying for the check

- Payor Address: Address of the person/entity who will be paying for the check

- Check Number: Identifies specific check being used for tracking and record-keeping

- Date: Date you are writing the check. Can also put a date in the future if you don’t want the check to be cashed before then.

- Amount(Numerals): Amount being paid in numerical form.

- Signature: Signature of the person writing the check. This step authorizes the check. If no signature, the check is invalid.

- Account Number: Identifies the specific account the money will be taken from.

- Routing Number: Identifies the financial institution the money will be taken from.

- Memo: This is optional. Used to describe the purpose of the check.

- Amount(Words): Amount being paid written out in words.

- Payee: Name of the person or organization receiving the money.

Want More? Some Quik Tips.

- For your records, it’s helpful to write down the check number (found in the top right-hand corner) and the corresponding amount you paid in a booklet or other financial tracking software you use.

- If you make a mistake, simply draw a single line through the error and rewrite it, putting your initials next to the change. If you’d rather not use the check at all anymore after the mistake, invalidate the check by writing “VOID” across the whole check and tear it in half.

- If you want a check to only be cashed after a specific future date, post date the check. You can do this by simply dating the check to that future date you’d like. NOTE: Banks don’t necessarily have to honor this post date and could still cash the check before the date anyway.

- You can write the check to yourself if you want to transfer money between accounts.

- If you’re worried about fraud, include lines at the end of each area of the check to ensure it cannot be changed.

- Make sure you have enough funds in your bank account to cover the payment.

- Use a pen, not a pencil so your check has less risk of being altered.

- Don’t hand over blank checks. This is an easy way for fraud to occur.