A credit score is a prediction of your credit worthiness. It is used by lenders like banks and credit card companies to gauge the likelihood an individual will pay back borrowed money.

Why is it important?

Loan Approval: A higher credit score equals a higher chance of getting approved for credit cards and loans

Cost of Borrowing: A higher credit score increases your chances of qualifying for lower interest rates on loans

Rent A Home: Some landlords check credit scores as part of rental application process

Insurance Rates: Insurance companies can use your credit score to determine premiums

And More!

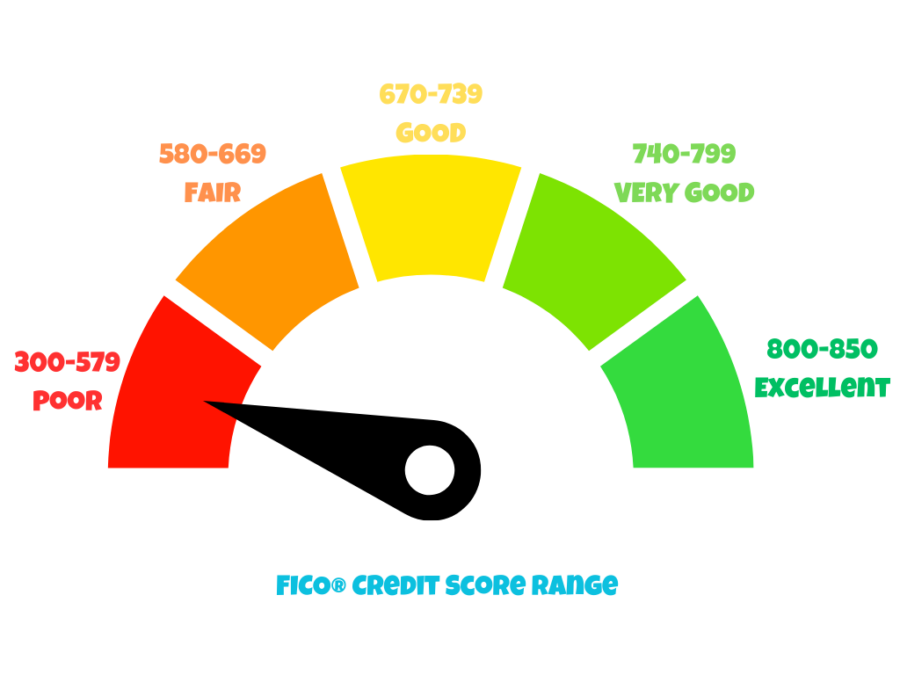

The chart below gives a good idea of what qualifies as a good (and not so good) credit score. Keeping this score as high as you can will help you out a ton in your financial jounrey,

How to Check Your Credit Score

There’s two types of scores you can use to track your credit health.

FICO Score – Most widely used credit score by lenders, banks and credit card companies.

Vantage Score – Another score to measure credit, but used less by lenders and not as useful of a way to track credit as compared to your FICO Score. This was created by the three major credit bureaus: Experian, Equifax and Transunion.

These scores can be found through separate means. We’ll show you how to check both your FICO Score and Vantage Score, but note that the FICO Score is a more accurate metric of what lenders will look at. Still, Vantage Score is a good metric and the way to track it is much easier

How To Check Your VantageScore

Step 1: Make an Account at CreditKarma

Go to CreditKarma.com and sign up for an account.

Your account at CreditKarma will give you access to great information about your credit and financial history. One important thing you’ll be able access is your VantageScore through two of the three major credit bureaus (Transunion and Equifax).

Other information you’ll be able to access includes:

- Credit Report (from Equifax & TransUnion)

- Credit Monitoring & Alerts (notifies you of significant changes)

- Credit Score Breakdown (shows factors affecting your score)

- Credit Score Simulator (see how actions impact your score)

- Personalized Recommendations (credit card, loan, and financial product suggestions)

- Account & Loan Tracking (monitor credit accounts and loans)

- Dispute Errors (dispute mistakes on your credit report)

- Basic Identity Monitoring (alerts for suspicious activity)

- Financial Tools & Calculators (calculators for payments, debt, etc.

While lenders are still only recently starting to use VantageScore, and FICO Score is still the top metric to many, access to all these features in CreditKarma is totally free and doesn’t hurt your credit by checking them unlike other means of checking credit.

How To Check Your FICO Score

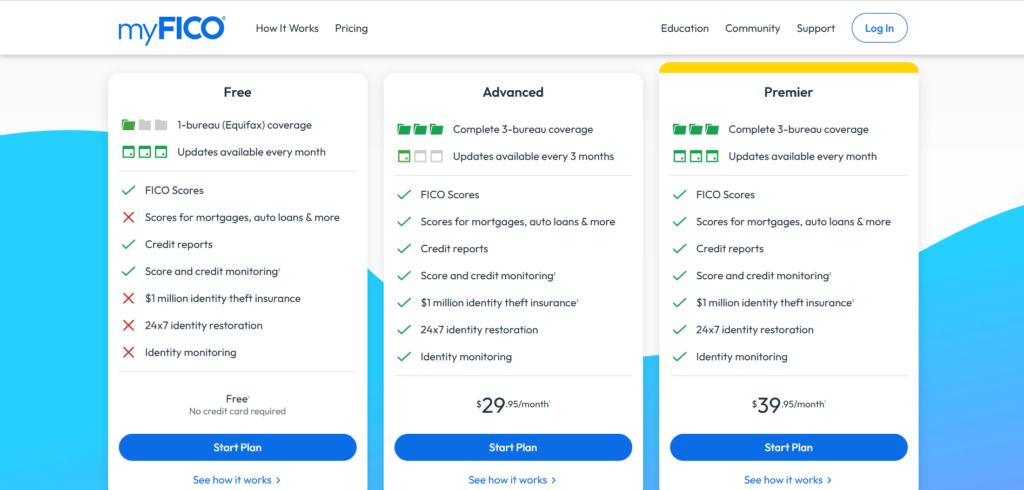

There’s so many ways to check your FICO Score. Since this is Quik Skool, we’ll give the simplest and free way: myFICO.com.

Step 1: Make an Account at myFICO.com

Create a free account with myFICO by clicking start plan and go through the steps outlined.

There are 3 bureaus that house your FICO score. They are Experian, Equifax and Transunion. The free version of myFICO allows you to access your Equifax score. This is a good gauge of the score that lenders will see.

Once you create your account and log in, you’ll see your FICO score from Equifax.

How To Improve Your Credit Score

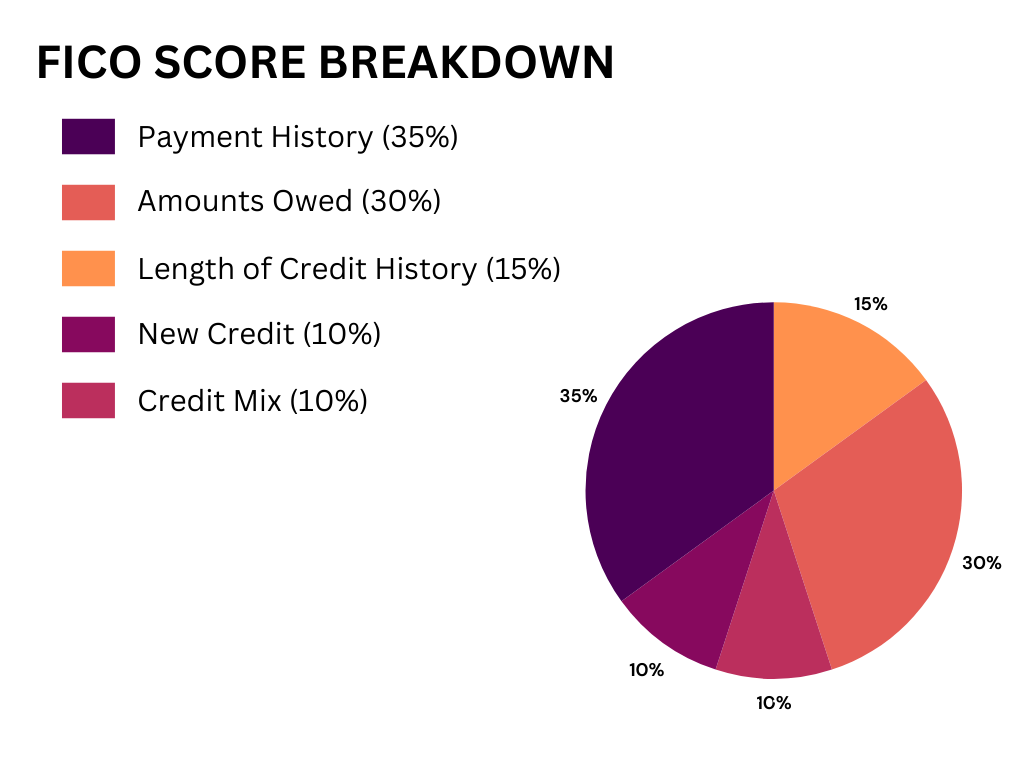

Since the FICO Score is the one most lenders look at, let’s deep dive how to improve that score. Look at the chart below to see the percent contribution of the different factors that go into your FICO credit score.

If you can improve these following areas, it will raise your credit score, giving you the advantages of great credit.

- Payment History: This tells lenders how often you pay you past credit accounts on time. This includes completing a loan payment every month, and paying your credit card bill every month. Note that while you can pay the minimum on the credit card and it won’t directly hurt your credit, this isn’t a smart strategy as you can accrue interest on the amount you don’t pay, as well as increase your credit utilization which affects the “Amounts Owed” portion.

- Amounts Owed: If the current amount of money you owe on your credit lines is high, this can tell banks you might be overextended, meaning you are at higher risk of defaulting. To improve this portion, pay your credit bill every month and clear any outstanding debts.

- Length of Credit History: This covers how long your credit account has been established. This includes the age of your oldest account, the age of your newest account and the average age of all your accounts.

- New Credit: When you apply for new credit, there is a hard inquiry on your credit information for lenders to determine if they’ll approve your credit request. This very slightly lowers your credit score for a temporary period (think 6 months to a year).

- Credit Mix: A credit mix such as credit cards as well as loans contributes to raising this portion, since it shows responsibility with different types of lending.

Quick Tips

- Making on time payments in full is crucial to having a good credit score.

- Keep old credit cards open even if you’re not using them. Length of credit history goes a long way in a good credit score.

- To set your children up with good credit, add them as an authorized user on your credit cards and maintain good payment history with them. You don’t even need to give them their own credit card to use!

- Credit utilization is a huge component in credit score. To improve this, ask your current credit card company to increase the limit of your card.

- By checking a site like Credit Karma, you can see credit report inaccuracies and dispute them.